- #Va loan mortgage calculator with taxes and insurance how to

- #Va loan mortgage calculator with taxes and insurance full

A VA entitlement is the maximum loan amount the VA office will pay your lender if you default on your mortgage loan, which is up to 25% of the loan amount. However, there is a limit to how much you can borrow without making a down payment, based on your VA entitlement. The VA does not impose a limit on how much you can borrow with a VA loan as long as it’s more than $144,000. You also can use your VA loan benefits throughout your lifetime. You can, however, use a VA loan to build a home, remodel an existing property or make a home more accessible if you have service-related disabilities. You can only use a VA loan on a property that’s your primary residence you can’t use it to buy a vacation home or an investment property.

#Va loan mortgage calculator with taxes and insurance full

You can check the VA’s full list of eligibility here. The lender will also require you to meet certain financial requirements, like demonstrating you can pay back your mortgage. Surviving spouses also can sometimes get VA loans if their husband or wife passed away while serving or due to a service-related disability, became a prisoner of war or went missing in action. You can apply for your COE online or by mail, or your VA lender can get it for you. You’ll also need a certificate of eligibility (COE) to participate in the VA loan program. If you were dishonorably discharged or did not serve long enough, you may not be able to get a VA loan. In order to qualify for a VA home loan, you must have served in the Army, Navy, Air Force, Marine Corps, Coast Guard, National Guard or reservist for a certain period of time. They also have more flexible standards that allow for a higher debt-to-income (DTI) ratio and lower credit score, making them easier to qualify for if you have less-than-perfect credit. With a VA loan, you usually have a low or no down payment requirement, and the interest rates tend to be lower than traditional mortgage options. This also means there is less risk to the lender, so you can get more favorable rates and terms. The Veterans Affairs office works with mortgage lenders by guaranteeing a portion of every VA home loan, so borrowers don’t have to make a down payment or pay for private mortgage insurance (PMI). However, your exact loan cost and terms will ultimately be determined by your lender.

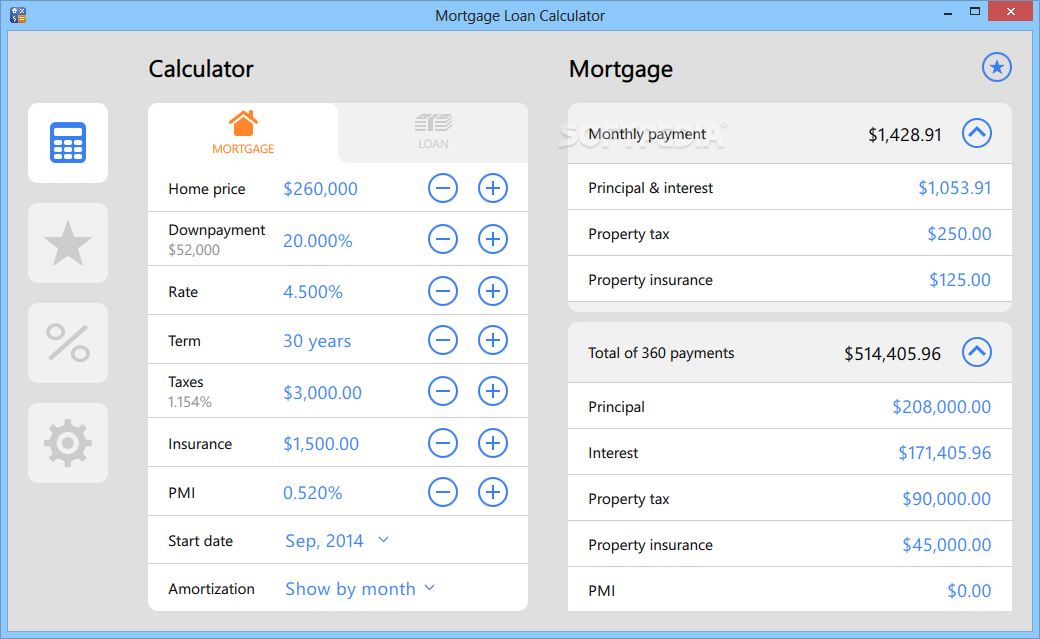

The more information provided, the more specific results the calculator can provide. You can also get a more detailed result by estimating the property’s annual tax cost and homeowners insurance fees as well as providing your military experience and whether you’ve used a VA loan in the past.

#Va loan mortgage calculator with taxes and insurance how to

Our guide also includes resources that help you make smarter decisions in your home-buying journey, instructions on how to use the calculator, and tips for decreasing the amount you pay per month for a mortgage in Texas.To use this VA loan calculator, input the following general information: Our calculator allows you to adjust the down payment, loan term, interest rate and input additional fees.

Using MoneyGeek’s Texas mortgage calculator, you can determine how much it costs to buy a house with all fees included. The average cost of homeowners insurance in Texas is $3,390, and HOA dues vary based on your location. Nonetheless, monthly mortgage payments in Texas are around $22 cheaper compared to the national average.Īt 1.80%, Texas has the 7th most expensive property tax rate in the United States the average cost per year for property taxes is $3,907. You must account for real estate taxes, insurance premiums and homeowners association (HOA) fees, when applicable, in your budget. If you want to buy a home in Texas, you should know that there are fees on top of the loan’s principal and interest payment.

0 kommentar(er)

0 kommentar(er)